Le barre d'armatura in polimero rinforzato con fibre (FRP), note anche come barre d'armatura composite, sono un'alternativa non metallica al rinforzo, utilizzata nelle strutture in calcestruzzo. Grazie all'eccezionale resistenza alla corrosione, all'elevata resistenza alla trazione e alla leggerezza, le barre d'armatura in FRP stanno rapidamente guadagnando terreno sul mercato globale, in particolare nei settori delle infrastrutture, delle costruzioni navali e dell'edilizia sostenibile. Questo articolo offre una previsione basata sui dati sulle dimensioni, le tendenze e i principali fattori trainanti del mercato globale delle barre d'armatura in FRP dal 2024 al 2030.

Dimensioni e previsioni del mercato (2024-2030)

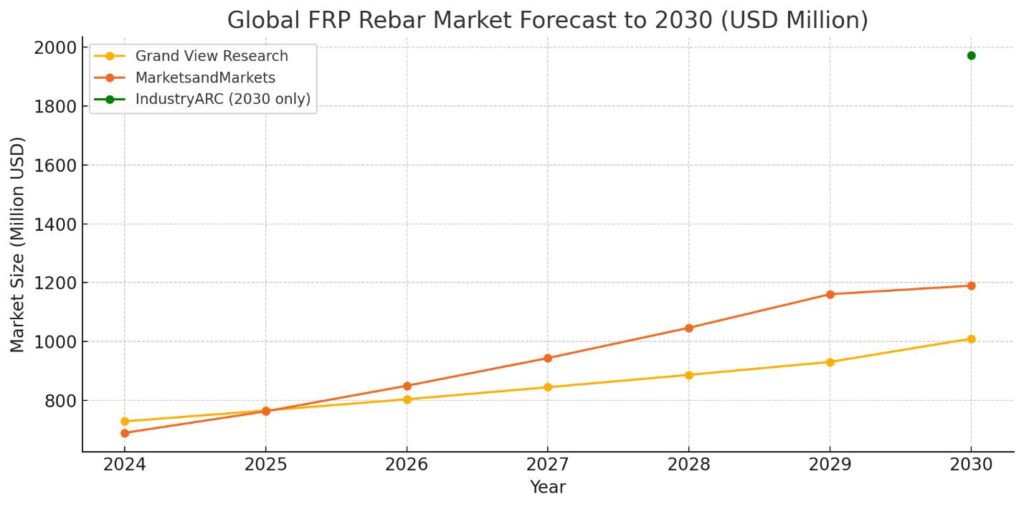

Secondo diverse agenzie di ricerca, il mercato globale delle barre d'armatura in FRP è in forte crescita:

- Grand View Research ha stimato che il mercato globale delle barre d'armatura FRP raggiungerà i 729,2 milioni di dollari nel 2024, con un valore previsto di 1,01 miliardi di dollari entro il 2030, con un CAGR di 5,7%.

- MarketsandMarkets prevede una crescita da 690 milioni di USD nel 2025 a 1,19 miliardi di USD entro il 2030, con un CAGR più elevato pari a 11,5%.

- IndustryARC prevede che il mercato raggiungerà 1,97 miliardi di dollari entro il 2030, con un CAGR di 11%.

- Secondo 360iResearch, il mercato nel 2024 avrebbe raggiunto gli 827,7 milioni di dollari, con una previsione di crescita fino a 1,54 miliardi di dollari entro il 2030.

CAGR medio tra le fonti: 9,2–11,5%, a seconda dell'ambito e del tipo di fibra inclusa (GFRP, CFRP, BFRP).

Principali fattori trainanti del mercato

- Resistenza alla corrosione in ambienti difficili

Il tondino in FRP è immune alla corrosione, un vantaggio significativo rispetto all'acciaio tradizionaleQuesta proprietà lo rende ideale per strutture marine, ponti, impianti chimici e ambienti antighiaccio, dove l'esposizione al cloruro accelera il degrado dell'acciaio. Secondo MarketsandMarkets, i costi di riparazione delle infrastrutture legate alla corrosione superano a livello globale i 2,5 trilioni di dollari all'anno, un'opportunità. barre d'armatura in FRP può affrontare.

- Elevata resistenza alla trazione e leggerezza

Le barre d'armatura in GFRP e CFRP offrono una resistenza alla trazione fino a due volte superiore a quella dell'acciaio con un quarto del peso, facilitando il trasporto e la movimentazione e riducendo al contempo i costi di manodopera e di fondazione.

- Domanda di infrastrutture sostenibili e verdi

Le barre d'armatura in FRP sono in linea con i requisiti LEED e con le iniziative di bioedilizia. Il loro lungo ciclo di vita e la ridotta manutenzione contribuiscono a ridurre le emissioni di carbonio, rendendole ideali per progetti infrastrutturali pubblici che danno priorità alla sostenibilità.

- Espansione degli investimenti nelle infrastrutture

Gli ingenti investimenti infrastrutturali, tra cui 1,2 trilioni di dollari negli Stati Uniti e l'ambizioso sviluppo dei trasporti in India e Medio Oriente, stanno stimolando la domanda di materiali durevoli e a bassa manutenzione come l'FRP.

Segmentazione del mercato

Per tipo di fibra:

- Fibra di vetro (GFRP): la più utilizzata grazie all'eccellente rapporto qualità-prezzo.

- Fibra di carbonio (CFRP): elevata resistenza, peso ridotto; utilizzata in strutture di fascia alta o antisismiche.

- Fibra di basalto (BFRP) – Segmento in crescita grazie alla stabilità termica.

Per tipo di resina:

- Estere vinilico – Segmento dominante; offre elevata resistenza chimica e forza di adesione.

- Epossidico e poliestere: utilizzati per ambienti economici o meno aggressivi.

Per diametro:

- Le barre d'armatura FRP <10 mm stanno crescendo più rapidamente, soprattutto per marciapiedi, solette residenziali e strutture leggere.

Per uso finale:

- Infrastrutture e autostrade

- Lavori marini e costieri

- Edifici (residenziali e commerciali)

- Estrazione mineraria e scavo di gallerie

- Pavimentazione industriale

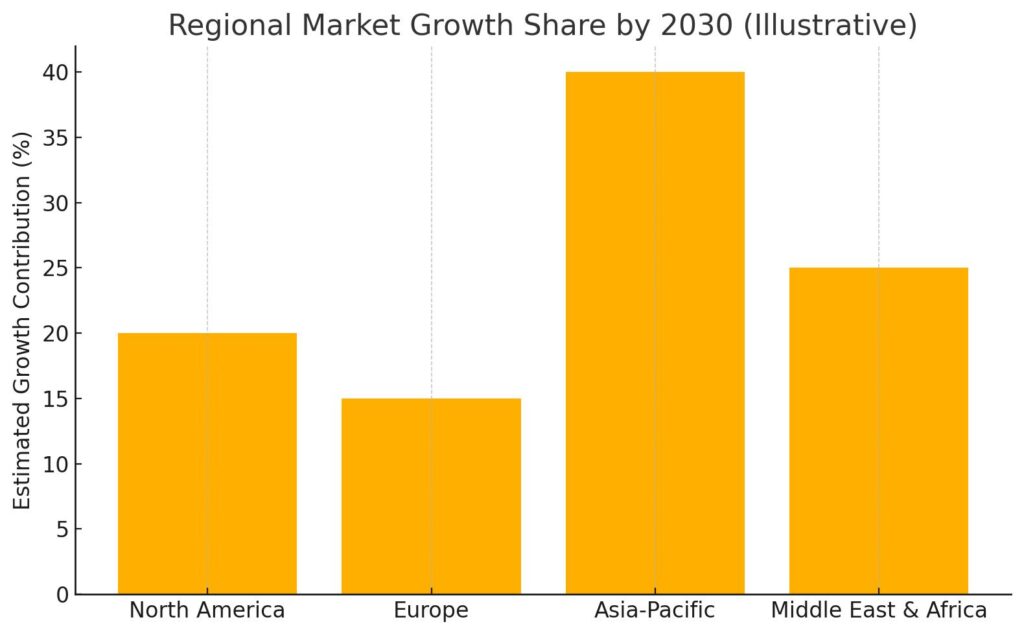

Approfondimenti regionali

| America del Nord | Europa | Asia-Pacifico | Medio Oriente e Africa |

| Gli Stati Uniti sono in testa all'adozione globale, trainati dal ripristino dei ponti, dalle infrastrutture soggette a corrosione e dall'inclusione nei codici edilizi ACI 440. | Gli obiettivi di sostenibilità dell'UE e i problemi di corrosione nei ponti più vecchi alimentano la domanda. Germania, Italia e Regno Unito sono i principali paesi che li hanno adottati. | Regione in più rapida crescita grazie alla rapida urbanizzazione e ai progetti infrastrutturali in Cina, India e nel Sud-est asiatico. | Elevata richiesta di materiali resistenti alla corrosione nelle regioni costiere e desertiche con ambienti aggressivi. |

Sfide e limitazioni

Nonostante la forte crescita, il settore delle barre d'armatura in FRP deve affrontare le seguenti sfide:

- Costo iniziale più elevato rispetto all'acciaio (~20–30% più costoso).

- Mancanza di codici standardizzati in alcuni paesi.

- Duttilità limitata: non adatto a tutte le applicazioni sismiche.

- Problemi di comportamento al fuoco se non rivestito o protetto.

Panorama competitivo

Tra i principali attori figurano:

- Sireg Geotech (Italia)

- Pultrall Inc. (Canada)

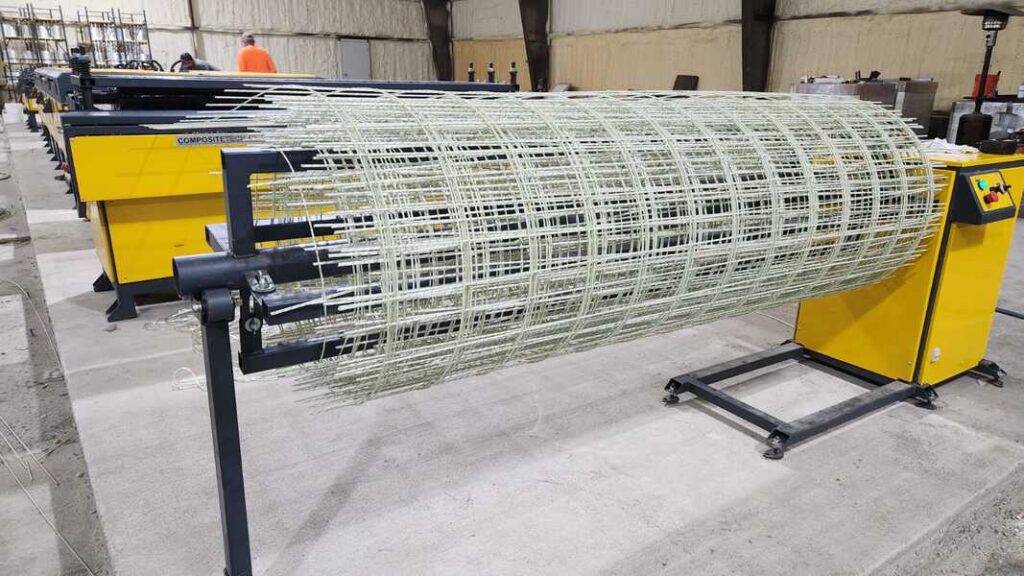

- Composite Rebar Technologies (USA)

- Dextra Group (Thailandia)

- FiReP Rebar Technology (Svizzera)

- Composite-Tech (Moldavia) — un produttore leader a livello mondiale di attrezzature, che fornisce linee di produzione avanzate di barre d'armatura in GFRP in oltre 25 paesi.

Tabella di confronto delle previsioni

| Società di ricerca | Linea di base 2024-25 | Linea di base 2024-25 | CAGR (%) |

| Grand View Research | $729,2 milioni | $1,01 miliardi | 5.7% |

| Mercati e mercati | $690 milioni | $1,19 miliardi | 11.5% |

| Ricerca 360i | $827,7 milioni | $1,54 miliardi | 10.9% |

| IndustryARC | — | $1,97 miliardi | 11% |

| Ricerca e mercati | $488,2 milioni | $821,8 milioni | 10.91% |

Conclusione

Il mercato delle barre d'armatura in FRP è destinato a raddoppiare il suo valore entro il 2030, trainato dalla resistenza alla corrosione, dalla longevità strutturale e dalla crescente domanda di sostenibilità. Le stime di CAGR globali oscillano tra 9% e 12%, posizionando l'FRP come componente fondamentale per il futuro del rinforzo del calcestruzzo.

Le aziende investono presto in GFRP e CFRP tecnologie, test standardizzati e divulgazione globale (ad esempio, Attrezzature Composite-Tech esportazioni) sono ben posizionate per dominare un mercato che si sta rapidamente spostando verso i materiali avanzati.